The low down

While there have been recent challenges for real estate owners and investors, with anaemic sales and value increases, things are looking brighter with improved momentum throughout the country. In this issue, we’ll look back at the challenges that have been faced recently, along with current and future trends in Australia and NSW.

Regrouping on past trends

Beginning in 2018 and early this year, the news for property owners and investors was gloomy, with the steepest downturn in Australia since the 1980s. As described by Brett Gilday at Money wise Financial Solutions in West Gosford: “New building projects were taken from the table, the cranes were still up but only finishing projects started years before, auction clearance rates declined, open homes were lonely places to be and property prices started to noticeably retreat.”

The pressure on the property market was affected by lending trends. This included government changes that tightened lending standards affecting new borrowers,those seeking to renegotiate their current lending, and new housing development. While changes to lending standards were needed, Brett Gilday explains: “as is often the case, government legislation comes too late, too hard and is left in place for too long.” As the real estate market is directly affected by the lending market, when the lending market dryed up, the property market invariably followed.

Things are looking up

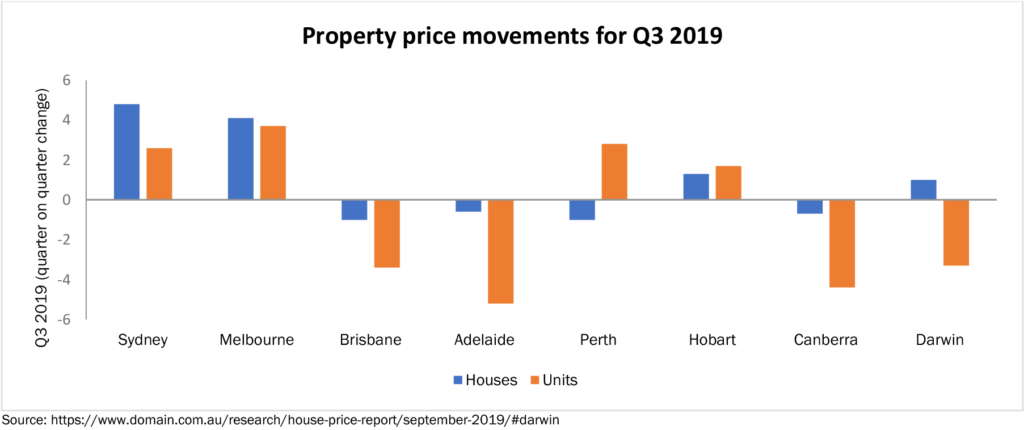

It now appears that the worst of this recent downturn has passed, with the Australian property market making a slow and steady recovery. However, these trends vary by region. In Australia’s major markets of Sydney and Melbourne, the median house price for the third quarter of 2019 increased, equating to a regain of about half of the price falls experienced in the recent downturn. However, these improvements have been slower to reach the comparatively smaller centres and haven’t been equally noted across states (for instance, all states apart from Western Australia are expecting positive gains in the coming year, with the greatest gains expected in NSW and Victoria according to the NAB Residential Property Index).

Similar trends in rental expectations are also predicted based on the most recent NAB Residential Property Index, with rents across Australia expected to grow by 1.4% and 2.4% in the next 12 and 24 months, respectively (consistent with predicted house price growth of 1.3% and 2.1%, respectively). However, growth in rents also varies by state, with the fastest expected in Queensland (2.3%) and the slowest in NSW (0.2%), which is lagging behind price growth and suggesting that yield compression may feature.